Fire can be both a devastating and transformative force in our lives. A flickering flame that once provided warmth and comfort can quickly become a source of destruction, leaving behind more than charred walls and ruined belongings. When disaster strikes, the value of your home is often one of the first things to take a hit. Also, can you sell a house with fire damage? The road to recovery may seem daunting, but with the right knowledge at your fingertips, you can navigate this challenge effectively and protect what matters most: your home’s value.

The Immediate Impact of a Fire on Home Value

A fire can change everything in an instant. The immediate aftermath often reveals a stark reality: significant structural damage that may render a home unsafe. Walls, roofs, and support beams can be compromised, leading to costly repairs. Then there’s smoke and soot residue. This isn’t just an aesthetic issue. It lingers long after the flames are extinguished. Removing this damage requires specialized cleaning methods, adding another layer of expense. Water damage from firefighting efforts is another concern. Fire hoses unleash immense amounts of water to control blazes, potentially warping floors and walls or creating conditions for mold growth.

Structural Damage

Structural damage is one of the most daunting consequences of fire. Flames can weaken beams, walls, and foundations in a matter of minutes. This compromise makes your home unsafe for occupancy. Even if the visible flames do not reach certain areas, heat can still warp materials and lead to hidden damage. Inspecting these aspects is essential for understanding how deep the destruction goes. Repairing structural issues often requires significant investment.

Smoke and Soot Residue

Smoke and soot residue can wreak havoc on a home’s interior. Even after the flames are extinguished, these remnants linger, often hidden from plain sight. Soot particles are tiny but incredibly sticky. They cling to walls, furniture, and even your belongings. This not only tarnishes surfaces but also creates an ongoing smell that can be hard to eliminate. The damage extends beyond aesthetics.

Water Damage From Fire Suppression Efforts

When a fire breaks out, firefighters act quickly to extinguish the flames. However, their efforts can lead to significant water damage within your home. The water used in suppression can saturate walls, floors, and ceilings. This moisture creates an environment ripe for mold growth if not addressed promptly.

Long-Term Effects of Fire Damage on Home Value

Fire damage doesn’t just leave a mark on the day of the incident; its repercussions can linger for years. One significant aspect is how it affects insurance premiums. Homeowners may face increased rates or difficulty securing coverage altogether, especially if previous claims have been made.

Insurance Premiums and Coverage

Fire damage can significantly impact your insurance premiums. After a fire, insurers often reassess the risk associated with your property. If they determine that your home is more susceptible to future incidents, you might face higher rates. Coverage limitations can also arise in the aftermath of a fire. Some policies may not cover specific types of damage or loss caused by smoke or water used during suppression efforts.

Potential Health Hazards

After a fire, the health risks in your home can be substantial. Smoke and soot permeate surfaces, leaving behind harmful residues. These particles can trigger respiratory issues or exacerbate existing conditions. Additionally, lingering odors can affect indoor air quality. Chemicals released during combustion may also pose serious long-term health effects if not addressed properly.

Steps to Take After a Fire to Protect Your Home’s Value

After experiencing a fire, your first step is to assess the damage. Walk through your home and take notes of affected areas. This documentation will be essential for insurance claims. Next, contact your insurance company immediately. Prompt communication can expedite the claims process, ensuring you receive any necessary assistance quickly. Consider hiring professionals for restoration services.

Long-Term Effects on Property Value

Fire damage doesn’t just impact your home in the immediate aftermath; it can have lasting effects on its market value. One of the most significant long-term repercussions is the potential increase in insurance premiums. Insurers often view homes with a fire history as higher risk, leading to inflated rates. Moreover, lingering odors and visible signs of smoke can deter potential buyers. Even after repairs, any evidence of previous fires might raise red flags during inspections.

Fire damage can be a devastating experience for any homeowner. Understanding its impact on your property value is crucial. The immediate effects, such as structural damage, smoke residue, and water damage from firefighting efforts, can significantly reduce the worth of your home. Long-term ramifications like increased insurance premiums and potential health hazards also come into play. These factors will not only affect your property’s marketability but may also deter future buyers.…

Dreams have a remarkable way of reflecting our innermost thoughts and emotions, often revealing aspects of ourselves that we may not be fully aware of in our waking lives. By keeping a dream journal, you can tap into this hidden wellspring of self-awareness and gain deeper insights into your own psyche. As you record your dreams on paper, patterns and themes may begin to emerge. You might notice recurring symbols or situations that hold significant meaning for you. These repetitions offer valuable clues about the parts of yourself that require attention or healing. Additionally, paying close attention to the emotions experienced during dreams can provide powerful insights into your emotional landscape.

Dreams have a remarkable way of reflecting our innermost thoughts and emotions, often revealing aspects of ourselves that we may not be fully aware of in our waking lives. By keeping a dream journal, you can tap into this hidden wellspring of self-awareness and gain deeper insights into your own psyche. As you record your dreams on paper, patterns and themes may begin to emerge. You might notice recurring symbols or situations that hold significant meaning for you. These repetitions offer valuable clues about the parts of yourself that require attention or healing. Additionally, paying close attention to the emotions experienced during dreams can provide powerful insights into your emotional landscape. Our emotions can sometimes feel overwhelming, like a tidal wave crashing over us. Anxiety and fear can weigh heavily on our minds, making it difficult to find relief or clarity. However, by keeping a dream journal and exploring the emotions that arise in our dreams, we can begin to release these pent-up feelings. We unlock a gateway into our subconscious mind when we record our dreams in detail. This allows us to process and release any suppressed emotions that may be contributing to anxiety and fear in our waking lives.

Our emotions can sometimes feel overwhelming, like a tidal wave crashing over us. Anxiety and fear can weigh heavily on our minds, making it difficult to find relief or clarity. However, by keeping a dream journal and exploring the emotions that arise in our dreams, we can begin to release these pent-up feelings. We unlock a gateway into our subconscious mind when we record our dreams in detail. This allows us to process and release any suppressed emotions that may be contributing to anxiety and fear in our waking lives.

The last celeb secret for beautiful feet is to exfoliate them. Victoria Beckham is known to exfoliate her feet with a pumice stone twice a week to slough away any dead skin cells. This will help reveal smoother, softer skin and bring out that natural glow. You can also use foot masks or scrubs to achieve the same effect. There are many brands and products on the market, so take the time to find something that works for you. You must first test the product on a small area of your foot before applying it all over. This way, you can make sure that the product is safe and won’t cause any irritation or damage to your skin.

The last celeb secret for beautiful feet is to exfoliate them. Victoria Beckham is known to exfoliate her feet with a pumice stone twice a week to slough away any dead skin cells. This will help reveal smoother, softer skin and bring out that natural glow. You can also use foot masks or scrubs to achieve the same effect. There are many brands and products on the market, so take the time to find something that works for you. You must first test the product on a small area of your foot before applying it all over. This way, you can make sure that the product is safe and won’t cause any irritation or damage to your skin.

Is your friend someone who casually enjoys a glass or two of wine with dinner? Or are they passionate and can talk your ear off about grape varietals, regions, and terroir? The answer to this question will help you determine what kind of gift to get them.

Is your friend someone who casually enjoys a glass or two of wine with dinner? Or are they passionate and can talk your ear off about grape varietals, regions, and terroir? The answer to this question will help you determine what kind of gift to get them. This consideration is closely related to the one above. But it’s not just about budget. It’s also about discovering what kind of wines they like to drink. It can be tricky if you’re not familiar with wine yourself. But there are a few things you can do to get an idea.

This consideration is closely related to the one above. But it’s not just about budget. It’s also about discovering what kind of wines they like to drink. It can be tricky if you’re not familiar with wine yourself. But there are a few things you can do to get an idea.

One of the most important things you need to do before getting started with resin epoxy art is to learn about the different types of resin. There are two main types of resin: polyester and epoxy. Each type of resin has its unique properties and uses. Polyester resin is typically used for casting objects, while the epoxy resin is often used for laminating and coating surfaces. If you’re just starting with resin epoxy art, then we recommend using epoxy resin. This type of resin is easier to work with and more forgiving if you make mistakes.

One of the most important things you need to do before getting started with resin epoxy art is to learn about the different types of resin. There are two main types of resin: polyester and epoxy. Each type of resin has its unique properties and uses. Polyester resin is typically used for casting objects, while the epoxy resin is often used for laminating and coating surfaces. If you’re just starting with resin epoxy art, then we recommend using epoxy resin. This type of resin is easier to work with and more forgiving if you make mistakes. Once you’ve mixed and poured your resin, it’s time to let your creativity flow. There are endless possibilities when it comes to resin epoxy art. You can use different colors, add glitter or other embellishments, and even create three-dimensional objects. The sky is the limit. So, go ahead and experiment until you find a style that you’re happy with.

Once you’ve mixed and poured your resin, it’s time to let your creativity flow. There are endless possibilities when it comes to resin epoxy art. You can use different colors, add glitter or other embellishments, and even create three-dimensional objects. The sky is the limit. So, go ahead and experiment until you find a style that you’re happy with.

One of the most important things you can do when packing a fragile item is to use plenty of bubble wrap or newspaper. It will help to protect the item from being damaged in transit. Make sure to wrap the item tightly to not move around inside the box.

One of the most important things you can do when packing a fragile item is to use plenty of bubble wrap or newspaper. It will help to protect the item from being damaged in transit. Make sure to wrap the item tightly to not move around inside the box. When packing a fragile item, you need to use a sturdy box. It will help to protect the object from being damaged in transit. Make sure that the package is big enough to move around inside without hitting the sides of the box.

When packing a fragile item, you need to use a sturdy box. It will help to protect the object from being damaged in transit. Make sure that the package is big enough to move around inside without hitting the sides of the box. When packing a fragile item, you need to ensure that there are no sharp edges inside the box. It could damage the item in transit. If you are using a cardboard box, make sure to cut off any excess flaps or tabs before putting the object in the box.

When packing a fragile item, you need to ensure that there are no sharp edges inside the box. It could damage the item in transit. If you are using a cardboard box, make sure to cut off any excess flaps or tabs before putting the object in the box.

The ability of the foam to expand once it hits the air means that it can be used for larger areas engulfed with fire. This cannot be said of water fire extinguishers. Once sprayed on a burning material, it smothers the fire to prevent oxygen from coming in and cools down the material, thus extinguishing the fire.

The ability of the foam to expand once it hits the air means that it can be used for larger areas engulfed with fire. This cannot be said of water fire extinguishers. Once sprayed on a burning material, it smothers the fire to prevent oxygen from coming in and cools down the material, thus extinguishing the fire. It Is Easy to Clean

It Is Easy to Clean

The best wine dispenser does not only ensure the efficiency of service, hygiene, preserving, and reporting, but it also increases the aesthetic value of an establishment. With its sleek design and LED lights in it, an entertainment venue will surely glow in beauty, especially when night falls.

The best wine dispenser does not only ensure the efficiency of service, hygiene, preserving, and reporting, but it also increases the aesthetic value of an establishment. With its sleek design and LED lights in it, an entertainment venue will surely glow in beauty, especially when night falls.

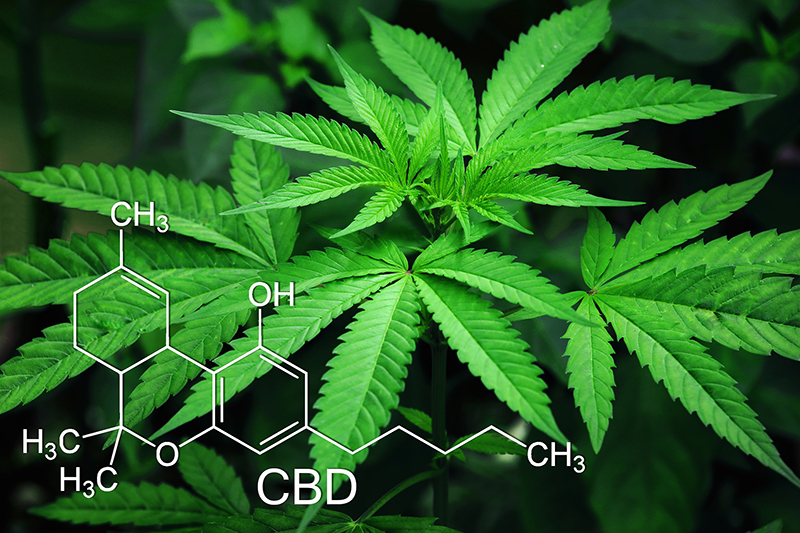

CBD can be quite expensive over time. Once you start looking for the perfect site that can help you with high-quality CBD pills, you will be surprised with the various options you get. You will find websites that are devoted to their specific brands exclusively. Then the big question that you should ask yourself, how can you compare and find the right online site with quality CBD products? Keep reading to find all the answers to your questions.

CBD can be quite expensive over time. Once you start looking for the perfect site that can help you with high-quality CBD pills, you will be surprised with the various options you get. You will find websites that are devoted to their specific brands exclusively. Then the big question that you should ask yourself, how can you compare and find the right online site with quality CBD products? Keep reading to find all the answers to your questions.

The right agency is one that provides you with one person to talk to about your needs. The person needs to be available via email or phone when you need them. If an agency is not giving you a platform to have a discussion about your job, leave it. The translation process should be interactive, collaborative and fluid until the end. The contact person should also talk in a language you understand. Do not work with someone who always uses technical jargon instead of simple English.

The right agency is one that provides you with one person to talk to about your needs. The person needs to be available via email or phone when you need them. If an agency is not giving you a platform to have a discussion about your job, leave it. The translation process should be interactive, collaborative and fluid until the end. The contact person should also talk in a language you understand. Do not work with someone who always uses technical jargon instead of simple English.

There are a lot of loan services out there that would be glad to give you some money in advance, but not every one of them is a great place to go. You need to find a business where they are honest, comes with a process that is not complicated, legit, reputable, and generous.

There are a lot of loan services out there that would be glad to give you some money in advance, but not every one of them is a great place to go. You need to find a business where they are honest, comes with a process that is not complicated, legit, reputable, and generous.  A responsible person and a smart one would have a saving just for in case. And this is the perfect time to use your savings because this means you do not have to owe anyone any money that is much better than having to pay the interest later if you get a loan. Though not everyone would have savings perhaps big enough for the emergency, often time this suggestion is not always a good one.

A responsible person and a smart one would have a saving just for in case. And this is the perfect time to use your savings because this means you do not have to owe anyone any money that is much better than having to pay the interest later if you get a loan. Though not everyone would have savings perhaps big enough for the emergency, often time this suggestion is not always a good one.

Nowadays, Christmas has lost its mystique. However, you do not need to worry anymore, as this day you can buy your ugly Christmas sweater. This is an amazing day that is meant to allow you loosen up from the corporate person to have fun with friends and family. In fact, it is the day to forget your business-oriented version and enjoy the holidays as they are intended to. You can leave your home and join your ugly sweater bandwagon.

Nowadays, Christmas has lost its mystique. However, you do not need to worry anymore, as this day you can buy your ugly Christmas sweater. This is an amazing day that is meant to allow you loosen up from the corporate person to have fun with friends and family. In fact, it is the day to forget your business-oriented version and enjoy the holidays as they are intended to. You can leave your home and join your ugly sweater bandwagon.

It is true laser hair removal is quite popular among women. But nowadays, even men are going to salons every year. They may not be revealing this to their colleagues, but they are enjoying the benefits of laser hair removal. This procedure can be used to eliminate unwanted hair on men’s arms, chest, and back. Other places where the technique can be used include the jawline and neck to create a polished, smooth look.

It is true laser hair removal is quite popular among women. But nowadays, even men are going to salons every year. They may not be revealing this to their colleagues, but they are enjoying the benefits of laser hair removal. This procedure can be used to eliminate unwanted hair on men’s arms, chest, and back. Other places where the technique can be used include the jawline and neck to create a polished, smooth look.

Also, referred to as 2lb foam is usually heavier than the open cell foam insulation. The closed cell foam insulation has a smaller, more compact cell structure. The closed cell foam insulation is a good air barrier and also a water barrier. Mostly the closed cell foam insulation is used in roofing projects or any other outdoor applications. However, it is used anywhere in the building in question.

Also, referred to as 2lb foam is usually heavier than the open cell foam insulation. The closed cell foam insulation has a smaller, more compact cell structure. The closed cell foam insulation is a good air barrier and also a water barrier. Mostly the closed cell foam insulation is used in roofing projects or any other outdoor applications. However, it is used anywhere in the building in question. Closed cell insulation is more expensive compared to the open cell foam insulation which is cheaper. It is stronger as compared to open foam insulation has a higher R-value, it is also suitable as a barrier to water and moister offering resistance to leakage. The main disadvantage is that it requires more material making it denser than the open cell foam insulator. The primary choice of the insulators solely dependent on the on the function of the insulation and the location of the area to be insulated.…

Closed cell insulation is more expensive compared to the open cell foam insulation which is cheaper. It is stronger as compared to open foam insulation has a higher R-value, it is also suitable as a barrier to water and moister offering resistance to leakage. The main disadvantage is that it requires more material making it denser than the open cell foam insulator. The primary choice of the insulators solely dependent on the on the function of the insulation and the location of the area to be insulated.…

The kitchen activities in homes attract various pests and rodents. The common pests at home are cockroaches, mites, and ants. However, the same can infest any other part of the house. Rodents like rats and mice are also a frequent visitors in kitchens and food stores especially at night when all is quiet. Well, with all these menaces, the pest control companies can come in handy and save the day. The will always start by assessing the situation to know how deep it is, then takes the necessary action as agreed.

The kitchen activities in homes attract various pests and rodents. The common pests at home are cockroaches, mites, and ants. However, the same can infest any other part of the house. Rodents like rats and mice are also a frequent visitors in kitchens and food stores especially at night when all is quiet. Well, with all these menaces, the pest control companies can come in handy and save the day. The will always start by assessing the situation to know how deep it is, then takes the necessary action as agreed. Most homes and premises can go through a hard time if mice and rats have heavily infested them. The two are almost similar and behaves the same way. They pose a risk of disease transmission especially if they carry some dangerous virus and bacteria. Wrong poisoning of the same can lead to health risk for pets and kids at home. Therefore, fumigation companies take strict health measure on the chemicals they use. They also advise the occupants of a home on how to keep them off by clearing the bushes around the house and sealing all the holes they might use to penetrate in.

Most homes and premises can go through a hard time if mice and rats have heavily infested them. The two are almost similar and behaves the same way. They pose a risk of disease transmission especially if they carry some dangerous virus and bacteria. Wrong poisoning of the same can lead to health risk for pets and kids at home. Therefore, fumigation companies take strict health measure on the chemicals they use. They also advise the occupants of a home on how to keep them off by clearing the bushes around the house and sealing all the holes they might use to penetrate in.

The first thing that you need to look for is a company that has been in business for long. Those businesses that have been in business for long will have an insight of the best method to use to dispose of the garbage. They will be able to understand what a customer needs within a short time of talking with him/her.

The first thing that you need to look for is a company that has been in business for long. Those businesses that have been in business for long will have an insight of the best method to use to dispose of the garbage. They will be able to understand what a customer needs within a short time of talking with him/her. Check if the company has the type and size that you need and will do a removal of the garbage properly. If you require a skip been for personal use this will not have to be a big one, any company that cares about the customer’s needs will know that clients have different needs and they will have all the skip bins needed.

Check if the company has the type and size that you need and will do a removal of the garbage properly. If you require a skip been for personal use this will not have to be a big one, any company that cares about the customer’s needs will know that clients have different needs and they will have all the skip bins needed.

When you buy the best mattress and cure your back pain, you save a lot of money which could otherwise be used in undertaking expensive back procedures. However, you have to be extra careful when purchasing a mattress because they come in different varieties. Choosing the best mattress is important when you suffer from back ache.…

When you buy the best mattress and cure your back pain, you save a lot of money which could otherwise be used in undertaking expensive back procedures. However, you have to be extra careful when purchasing a mattress because they come in different varieties. Choosing the best mattress is important when you suffer from back ache.…

A good nanny takes care of your child by promoting good behavior, encouraging learning and taking care of your child’s health. This will allow working parents to actually focus on their work. Therefore, the parents will not have to worry about the health and safety of their kids. Also, parents can manage their time and concentrate on other productive activities as the nanny takes care of their children. In a case of a sudden illness, parents can be assured that their nanny will provide the immediate medication or step.

A good nanny takes care of your child by promoting good behavior, encouraging learning and taking care of your child’s health. This will allow working parents to actually focus on their work. Therefore, the parents will not have to worry about the health and safety of their kids. Also, parents can manage their time and concentrate on other productive activities as the nanny takes care of their children. In a case of a sudden illness, parents can be assured that their nanny will provide the immediate medication or step. It is cheaper hiring a nanny than taking your kid to a daycare center. Also, it is healthier keeping your children at home because this will decrease the cost of your kid getting sick since he or she will be exposed to germs. It is crucial to hire a nanny that can perform other chores such as tidying the house, preparing meals and doing laundry. This will help you to save some amount of money that you could use on those activities.…

It is cheaper hiring a nanny than taking your kid to a daycare center. Also, it is healthier keeping your children at home because this will decrease the cost of your kid getting sick since he or she will be exposed to germs. It is crucial to hire a nanny that can perform other chores such as tidying the house, preparing meals and doing laundry. This will help you to save some amount of money that you could use on those activities.…

Almost everyone has been locked out of his house at one point or another. This has been orchestrated by either losing the house keys or locking the house keys inside the house. One way of gaining access to the house in such a scenario and you have no spare key is contacting the locksmith. The locksmiths are specially trained to unlock all the types of locks.

Almost everyone has been locked out of his house at one point or another. This has been orchestrated by either losing the house keys or locking the house keys inside the house. One way of gaining access to the house in such a scenario and you have no spare key is contacting the locksmith. The locksmiths are specially trained to unlock all the types of locks. Last but not least, the other service that is offered by the locksmith is the service call. For instance, there might be something that is wrong with your lock which may require the attention of the locksmith. The locksmith will provide you with what is referred to as a service call. Depending with the locksmith he will bill you on an hourly rate.

Last but not least, the other service that is offered by the locksmith is the service call. For instance, there might be something that is wrong with your lock which may require the attention of the locksmith. The locksmith will provide you with what is referred to as a service call. Depending with the locksmith he will bill you on an hourly rate.

The roaster is not only about roasting food items; you will be delighted to discover that it can do so much more than just roasting meats. An electric roaster will bake and steam your food as well. It will not do it the ordinary way that we are used to and provide the same old results that have been in existence since time immemorial. Now that you have known all its other functions, it is possible to cook the following items using it;

The roaster is not only about roasting food items; you will be delighted to discover that it can do so much more than just roasting meats. An electric roaster will bake and steam your food as well. It will not do it the ordinary way that we are used to and provide the same old results that have been in existence since time immemorial. Now that you have known all its other functions, it is possible to cook the following items using it; It is fast – Don’t expect your food to take too long before it is ready. The length of time it takes depends on the level of heat you set on the roaster.

It is fast – Don’t expect your food to take too long before it is ready. The length of time it takes depends on the level of heat you set on the roaster.

Instagram is now the talk of the town as everyone is speaking of that picture, so it is critical to making your picture the talk on Instagram. So as your picture adjust the view, it is very necessary to move a step ahead to make your followers have something to talk about.

Instagram is now the talk of the town as everyone is speaking of that picture, so it is critical to making your picture the talk on Instagram. So as your picture adjust the view, it is very necessary to move a step ahead to make your followers have something to talk about. Mirror frames come with different styles from reflectors to the eye on the sun or moon. This also portrays the nature making you looks like the eye watcher of the earth as you appear to be in the sun.So as you are planning to frame your pictures on Instagram, it is very necessary to see and pick what you think your fans loves most making your pictures a standout pictures.…

Mirror frames come with different styles from reflectors to the eye on the sun or moon. This also portrays the nature making you looks like the eye watcher of the earth as you appear to be in the sun.So as you are planning to frame your pictures on Instagram, it is very necessary to see and pick what you think your fans loves most making your pictures a standout pictures.…

This should be the first thing that you should always look at before buying a bulb. Watts measure that amount of energy that is required to light the bulb. On the other hand, the lumen is a term that is used to describe the amount of the light that is produced by the bulb. When you go the shop make sure that you buy a bulb that has the lowest watts and the same time high lumens. Such bulbs are of high quality, and they have many benefits one of it being that they do not consume lots of energy. This, therefore, means that you will be able to save a lot of cash when it comes to paying of the electricity bills. Also, the quality of the light produced by this kind of bulbs is impressive.

This should be the first thing that you should always look at before buying a bulb. Watts measure that amount of energy that is required to light the bulb. On the other hand, the lumen is a term that is used to describe the amount of the light that is produced by the bulb. When you go the shop make sure that you buy a bulb that has the lowest watts and the same time high lumens. Such bulbs are of high quality, and they have many benefits one of it being that they do not consume lots of energy. This, therefore, means that you will be able to save a lot of cash when it comes to paying of the electricity bills. Also, the quality of the light produced by this kind of bulbs is impressive. You also need to look at the voltage of the bulb that you want to buy. This is what will give you the maximum efficient that you will desire as long as the lighting of your home is concerned. It is recommended that whenever you go to buy a bulb, ensure that the voltage on the bulb matches the supplied voltage of your fixture. You also need to understand that low voltage draws lots of currents and also high voltage reduces the life of the battery.…

You also need to look at the voltage of the bulb that you want to buy. This is what will give you the maximum efficient that you will desire as long as the lighting of your home is concerned. It is recommended that whenever you go to buy a bulb, ensure that the voltage on the bulb matches the supplied voltage of your fixture. You also need to understand that low voltage draws lots of currents and also high voltage reduces the life of the battery.…

Just like when a purchasing a product, we always have in mind what we need. The companies might put in ads fabulous things on what they promise to offer. Hence you should take care so that their marketing strategies will not mislead you. You should look therefore decide what you need. There are many types of services including link removal, link building, retargeting or content management. One company may be good in one but not the other so exercise caution.

Just like when a purchasing a product, we always have in mind what we need. The companies might put in ads fabulous things on what they promise to offer. Hence you should take care so that their marketing strategies will not mislead you. You should look therefore decide what you need. There are many types of services including link removal, link building, retargeting or content management. One company may be good in one but not the other so exercise caution. The process will tell you something about the service. But that does not mean a high price means a good service. Sometimes companies can be extravagant on their prices. Therefore be keen to choose a company that will provide a service worth their price. All these will assist you to get a good firm. This will make certain that you get the best SEO service in your area. However, there might be exceptions. In such exceptions, you must exercise caution as not only your money is at stake, but the future of your business too.…

The process will tell you something about the service. But that does not mean a high price means a good service. Sometimes companies can be extravagant on their prices. Therefore be keen to choose a company that will provide a service worth their price. All these will assist you to get a good firm. This will make certain that you get the best SEO service in your area. However, there might be exceptions. In such exceptions, you must exercise caution as not only your money is at stake, but the future of your business too.…

e several projects that involve the specification and design of the public space such as restaurants and hotels. Commercial design requires most of your attention because it involves most of the activities not just the decoration of the commercial space. Maximization and design of space, plumbing and power systems, and lighting and ceiling options are some of the issues that commercial design entails. Therefore, this work requires professionals and experts to have a better grasp of architecture to help you in creating attractive settings alongside the commercial space. The following are some of the elements of the commercial interior design you need to consider

e several projects that involve the specification and design of the public space such as restaurants and hotels. Commercial design requires most of your attention because it involves most of the activities not just the decoration of the commercial space. Maximization and design of space, plumbing and power systems, and lighting and ceiling options are some of the issues that commercial design entails. Therefore, this work requires professionals and experts to have a better grasp of architecture to help you in creating attractive settings alongside the commercial space. The following are some of the elements of the commercial interior design you need to consider ther element that should be considered because it works together with the color palette. It is crucial to design a lighting system which facilitates enough illumination that will enhance productive work. Some of the commercial buildings require overhead lighting. So you are required to find the light fixtures that will produce enough illumination without being too glaring or harsh.

ther element that should be considered because it works together with the color palette. It is crucial to design a lighting system which facilitates enough illumination that will enhance productive work. Some of the commercial buildings require overhead lighting. So you are required to find the light fixtures that will produce enough illumination without being too glaring or harsh.

Experience is a major factor when it comes to how they will handle your work. Well, experience and professional staff will be thorough in stock taking before packaging, package all the household items well and remove them using the professional and trained methods. The most important are to know that they will handle the heavy furniture and other apparatus in the best way possible. Let the manager assure you that the team is the best they have.

Experience is a major factor when it comes to how they will handle your work. Well, experience and professional staff will be thorough in stock taking before packaging, package all the household items well and remove them using the professional and trained methods. The most important are to know that they will handle the heavy furniture and other apparatus in the best way possible. Let the manager assure you that the team is the best they have. No one would like to lose in one day all the household goods accumulated over time. However, hiring a company without a valid insurance cover for the work they perform is doing exactly that. Reputable companies will always comply and be ready to present a proof to a client for verification. On the same not, also ask about the license to operate as removal companies. This also means they have met the minimum requirements set by law.

No one would like to lose in one day all the household goods accumulated over time. However, hiring a company without a valid insurance cover for the work they perform is doing exactly that. Reputable companies will always comply and be ready to present a proof to a client for verification. On the same not, also ask about the license to operate as removal companies. This also means they have met the minimum requirements set by law.

ded. Also, the delivery charges will be less if it is near your house.

ded. Also, the delivery charges will be less if it is near your house.

pets unless they see a proof in the form of documentation. Therefore, having registered your dog will then proof beyond reasonable doubt that the dog is vaccinated and ready to serve in case of need.

pets unless they see a proof in the form of documentation. Therefore, having registered your dog will then proof beyond reasonable doubt that the dog is vaccinated and ready to serve in case of need. For emergency evacuation; if you produce the documentation, then the officials will be able to identify who the right owner is. A reunion in the case of separation during such procedures is also easy. This will give you a better result, and you can handle the emergency situation smartly.

For emergency evacuation; if you produce the documentation, then the officials will be able to identify who the right owner is. A reunion in the case of separation during such procedures is also easy. This will give you a better result, and you can handle the emergency situation smartly.

dividual with a disability.

dividual with a disability. de A Constant Companion

de A Constant Companion

other people who come to your home. When you install the wood floors, you also make it attractive to potential buyers in case you want to resell it in the future. This makes your home attract buyers fast and sell it at a higher value.

other people who come to your home. When you install the wood floors, you also make it attractive to potential buyers in case you want to resell it in the future. This makes your home attract buyers fast and sell it at a higher value. ry easy to maintain wood flooring regarding the work involved and cost in the process. It just involves cleaning it perfectly and repair any problem you recognize to ensure that it maintains its beauty for many years. You can also do most of the simple maintenance work by yourself without involving professionals who will charge you.

ry easy to maintain wood flooring regarding the work involved and cost in the process. It just involves cleaning it perfectly and repair any problem you recognize to ensure that it maintains its beauty for many years. You can also do most of the simple maintenance work by yourself without involving professionals who will charge you.

design that is combined with a sturdy and quality construction to enhance performance and longevity. The machine comes with disposable K-Cups combined with a reusable filter making it ideal for the environmentally conscious user.

design that is combined with a sturdy and quality construction to enhance performance and longevity. The machine comes with disposable K-Cups combined with a reusable filter making it ideal for the environmentally conscious user. Despite being rated as the top single-serve machine, the Cuisinart SS-700 has a few drawbacks. It is quite large for its category, and the K-Cup is only an ounce per cup of coffee. Nonetheless, it is still a good machine with quality performance and a broad range of options for preparing your favorite beverages.

Despite being rated as the top single-serve machine, the Cuisinart SS-700 has a few drawbacks. It is quite large for its category, and the K-Cup is only an ounce per cup of coffee. Nonetheless, it is still a good machine with quality performance and a broad range of options for preparing your favorite beverages.

n be designed in any size and shape to fit the available space.

n be designed in any size and shape to fit the available space. The terra-cotta is looking stamped concrete patio can then be accented with other colors to create that natural stone appearance you have ever wanted.

The terra-cotta is looking stamped concrete patio can then be accented with other colors to create that natural stone appearance you have ever wanted.

account with them. It is because the success of the robot will also depend on the kind of a broker you have decided to help trade in the binary options market.

account with them. It is because the success of the robot will also depend on the kind of a broker you have decided to help trade in the binary options market. If you want to execute trading using the software manually, which involves using the information generated by the robot to make investment decisions and trade on your on, you can still do it effectively. The estimated level of accuracy for manual trading using the system ranges between 75 and 80 percent. It indicates a positive outcome and thus recommendable for you.

If you want to execute trading using the software manually, which involves using the information generated by the robot to make investment decisions and trade on your on, you can still do it effectively. The estimated level of accuracy for manual trading using the system ranges between 75 and 80 percent. It indicates a positive outcome and thus recommendable for you.

Several factors may affect internet speed whenever VPNs are used. Some may include:

Several factors may affect internet speed whenever VPNs are used. Some may include: Whereas VPNs will normally reduce your downloading speed, they will increase it in case you are in a poor Internet condition. Connecting to a VPN while playing a game on a foreign server can also enable you to get faster Internet.…

Whereas VPNs will normally reduce your downloading speed, they will increase it in case you are in a poor Internet condition. Connecting to a VPN while playing a game on a foreign server can also enable you to get faster Internet.…

Remember, excrement of these animals can cause some considerable health dangers, for example, Histoplasmosis to the inhabitants of the house. Services of bat guano removal are professional and can help one get rid of the guano and soiled insulation from a building.

Remember, excrement of these animals can cause some considerable health dangers, for example, Histoplasmosis to the inhabitants of the house. Services of bat guano removal are professional and can help one get rid of the guano and soiled insulation from a building.

garments, with the application via non-adhesive sewing or with heat press application utilizing adhesive films that bond to the fabric. Whatever the application, a reflective tape is created for one thing; promoting better visual t avoid accidents. Reflective tapes can helpful any business environment, helping you lessen the risk of injury in the work area.

garments, with the application via non-adhesive sewing or with heat press application utilizing adhesive films that bond to the fabric. Whatever the application, a reflective tape is created for one thing; promoting better visual t avoid accidents. Reflective tapes can helpful any business environment, helping you lessen the risk of injury in the work area. It is used in marking posts in scouting competitions and also marking the itinerary to keep athletes on the right track and not wander away. It is not uncommon to see runners, bikers, vehicles, etc. using it so as to be easily noticed from a distance as well as for safety.…

It is used in marking posts in scouting competitions and also marking the itinerary to keep athletes on the right track and not wander away. It is not uncommon to see runners, bikers, vehicles, etc. using it so as to be easily noticed from a distance as well as for safety.…

If you read the Apple reviews, you will see how amazing each and every model is. This is the main reason why millions and millions of people across the globe get so excited every time the company announces the launching of a new device.

If you read the Apple reviews, you will see how amazing each and every model is. This is the main reason why millions and millions of people across the globe get so excited every time the company announces the launching of a new device. Despite the many applications that you can download on your Apple device, you can be confident that its battery life will last a long time. You won’t have to worry about looking for your charger after just a couple of hours of using your gadget, unlike the other smartphones that are being offered today.…

Despite the many applications that you can download on your Apple device, you can be confident that its battery life will last a long time. You won’t have to worry about looking for your charger after just a couple of hours of using your gadget, unlike the other smartphones that are being offered today.…

primary concern for any property buyer. Make sure you do a background check of the area to ascertain how secure the area is. It is every home owner’s wish to live in a safe place where you can check in at any time, and your house is secure even when you are away. Failure to look at the security, you may end up

primary concern for any property buyer. Make sure you do a background check of the area to ascertain how secure the area is. It is every home owner’s wish to live in a safe place where you can check in at any time, and your house is secure even when you are away. Failure to look at the security, you may end up

If you are a band of city slickers that are interested in knowing what it is like to stay and sleep in a house that does not have concrete for walls or bricks or galvanized iron for the roof, you will want to book one of the bamboo houses in Tropical Treehouse, Puerto Rico. This is the type of accommodation in which you will be able to experience nature at its finest.

If you are a band of city slickers that are interested in knowing what it is like to stay and sleep in a house that does not have concrete for walls or bricks or galvanized iron for the roof, you will want to book one of the bamboo houses in Tropical Treehouse, Puerto Rico. This is the type of accommodation in which you will be able to experience nature at its finest. Bolivia has a unique accommodation offering as well, in the form of Colibri Camping. Its eco-lodges have been crafted out of recycled materials. Thus, the conical-shaped cabins are capable of enticing anyone who has a deep passion for adventure and culture immersion. You and your loved ones can book some of these lodges and wake up feeling like you have truly experienced it all.…

Bolivia has a unique accommodation offering as well, in the form of Colibri Camping. Its eco-lodges have been crafted out of recycled materials. Thus, the conical-shaped cabins are capable of enticing anyone who has a deep passion for adventure and culture immersion. You and your loved ones can book some of these lodges and wake up feeling like you have truly experienced it all.…

you can choose. The light control offers minimal control without binding. The moderate control provides additional smoothness.

you can choose. The light control offers minimal control without binding. The moderate control provides additional smoothness. The budget is also an important consideration when buying a body shaper. The shapewear comes in different price ranges. The price depends on the material use and design.

The budget is also an important consideration when buying a body shaper. The shapewear comes in different price ranges. The price depends on the material use and design.

The set goals will be achieved easily if ROI is vividly defined. Leads, sales, conversations as well as time saved can be analyzed to gauge the return on investment state. A good business should have goals and strategies to achieve them. Also, define metrics in a way that best suits your needs.

The set goals will be achieved easily if ROI is vividly defined. Leads, sales, conversations as well as time saved can be analyzed to gauge the return on investment state. A good business should have goals and strategies to achieve them. Also, define metrics in a way that best suits your needs.

stery system?

stery system? you have different skills, but you would wish to boost them. A 12-week mastery system can expand every skill with a little practice that can help you be more efficient in just two weeks. Besides, you have to try this training, and you will see how it can help you achieve your goal at an incredible speed.

you have different skills, but you would wish to boost them. A 12-week mastery system can expand every skill with a little practice that can help you be more efficient in just two weeks. Besides, you have to try this training, and you will see how it can help you achieve your goal at an incredible speed.

website as a way of connecting with people from around the world who share the same passion and interests as them.

website as a way of connecting with people from around the world who share the same passion and interests as them. Right now, News Ledge focuses on publishing articles like reviews, personal essays, and reaction pieces. However, the two creators and founders of the site have hinted that they are in the process of producing other types of content like podcasts and videos.

Right now, News Ledge focuses on publishing articles like reviews, personal essays, and reaction pieces. However, the two creators and founders of the site have hinted that they are in the process of producing other types of content like podcasts and videos.

that they are flying insects. Mosquito bites can be very painful, and mosquitoes around the home make it uncomfortable to sleep. To control, mosquitoes make sure that you avoid any form of stagnant water in the home. Stagnant water in the home encourages the breed of mosquitoes.

that they are flying insects. Mosquito bites can be very painful, and mosquitoes around the home make it uncomfortable to sleep. To control, mosquitoes make sure that you avoid any form of stagnant water in the home. Stagnant water in the home encourages the breed of mosquitoes. olling rodents

olling rodents

ous types of espresso machines is ease of use and convenience. You can understand how easy it is to use different types by reading through the description of the different espresso machines. If you want an automated machine, you can find one.

ous types of espresso machines is ease of use and convenience. You can understand how easy it is to use different types by reading through the description of the different espresso machines. If you want an automated machine, you can find one. espresso machines can be pretty big. If you have limited space, you need to go for small sized ones so that you can have enough space for other appliances too. Some of the bigger models have the ability to make two espresso shots at once. They also have extra features you can use when making your espresso. So, the size you buy will be highly determined by your individual circumstances and preferences.

espresso machines can be pretty big. If you have limited space, you need to go for small sized ones so that you can have enough space for other appliances too. Some of the bigger models have the ability to make two espresso shots at once. They also have extra features you can use when making your espresso. So, the size you buy will be highly determined by your individual circumstances and preferences.

Moving furniture or goods from one location to another is expensive and thus getting the best deal can be a motivating factor to choosing a backloader. Some backloading service providers charge their customers a return journey fee, which makes the entire cost expensive.

Moving furniture or goods from one location to another is expensive and thus getting the best deal can be a motivating factor to choosing a backloader. Some backloading service providers charge their customers a return journey fee, which makes the entire cost expensive.

• Always stick to your budget

• Always stick to your budget